What Does a Loss-Adjuster Do?

Insurance companies are generally reluctant to pay out large settlements to policyholders. They might therefore call upon a loss adjuster to investigate your case.

A loss adjuster is a claims specialist appointed and paid by an insurance company to investigate a complex or contentious claim on their behalf. They are responsible for establishing the cause of a loss and to determine whether it is covered by your insurance policy. They will therefore visit the site of the loss in order to gather evidence and assess damage. In some cases, your insurance company may even hire private and forensic investigators to work on their behalf. These investigators are more often than not completely unregulated, and they will go out of their way to discredit your claim.

They will then present the insurance company with a report, recommending appropriate payment based on their perceived validity of the claim. Essentially, they review your claim from the insurance company’s perspective.

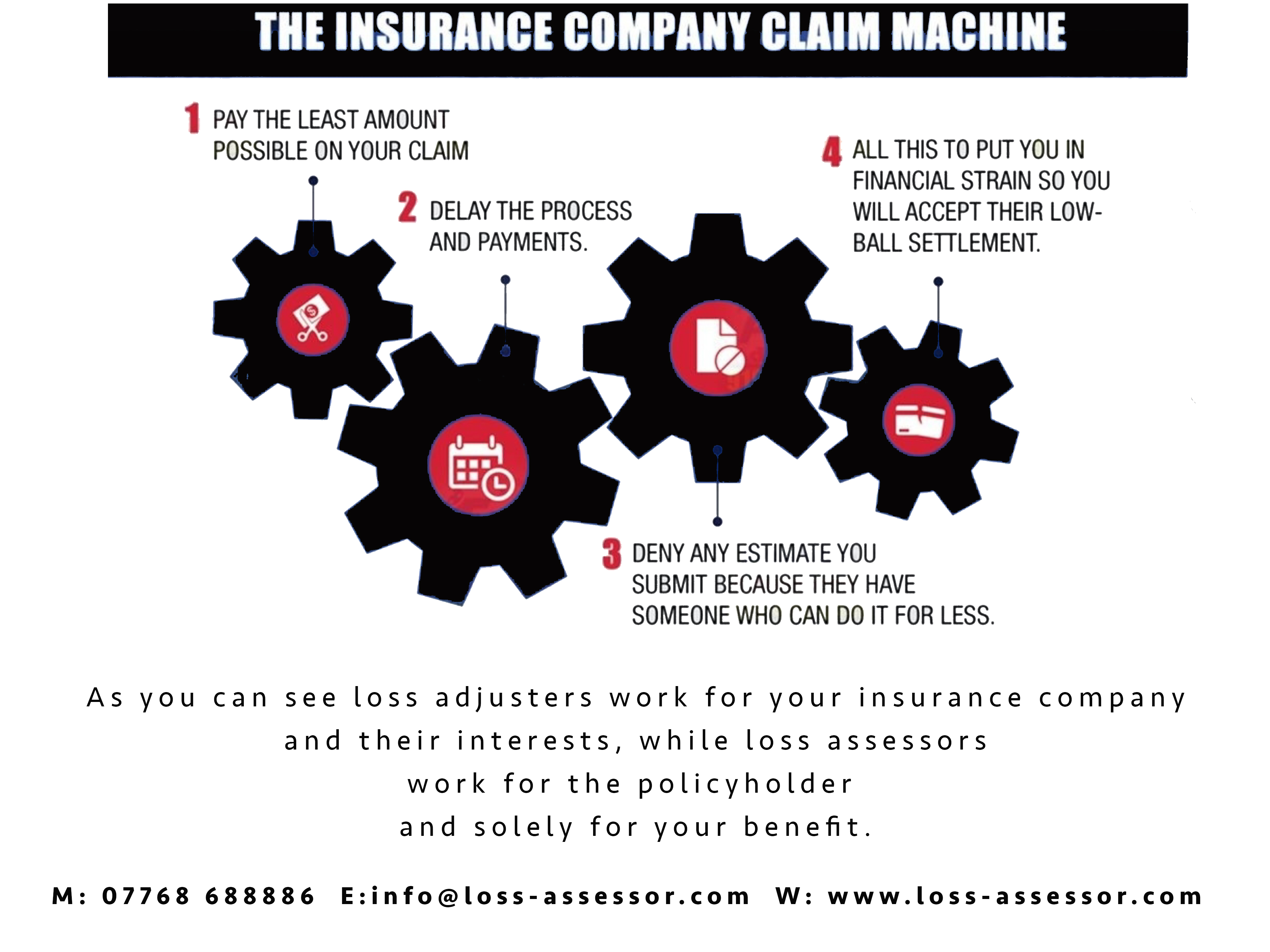

Because they are in the pay of insurance companies, loss adjusters might actively work to secure the lowest possible settlement. They are ostensibly hired to find evidence that could negate your claim. For that reason, it is important to have a qualified loss assessor fighting your corner.

They are not appointed to advise you on the best way for you to make a claim – they only look at the incident in the context of your policy cover, and the remit they have with your insurer.

They will not help you if you want to dispute a settlement offer – the onus is on you to prove you are entitled to more than the offer recommended to your insurer by the loss adjuster.

In some cases, it might feel as though loss adjusters are actively working against your best interests. But if you appoint a loss assessor, they will fight your corner and expertly negotiate your claim on your behalf.

It pays to appoint them as early in the claim as you can. If you appoint a loss assessor after the loss adjuster’s report has been submitted, it can be very difficult to challenge their decision.

What Does a Loss-Assessor Do?

Loss Assessors are appointed by policyholders to manage a claim on their behalf. They can be called on to help with all manner of loss-related insurance claims. Perhaps your business or property has been damaged by fire, flood, storms or subsidence. Or perhaps theft has robbed you of the irreplaceable.

A qualified loss assessor will handle every aspect of your claim process. They will help with every stage of your claim, from the paperwork to the more practical aspects. They will meet with insurance company representatives, or their appointed loss adjusters, in order to negotiate the best possible claim settlement for you.

- They’re excellent negotiators and experts when it comes to policy terms and conditions.

- They know how to properly quantify claims to ensure that you claim for an accurate and realistic amount.

- They have a thorough understanding of how the insurance company claims department work.

- They strive to obtain interim payments when you need them.

- They never work for insurance companies, and they are the only parties in the entire claims process who can be trusted to act entirely on your behalf.

A loss-assessor can also be called upon to assist in cases where an insurance company has declined a claim, or where settlements have been otherwise delayed.

Please fill in the below form giving your mobile or landline in the message section and we will be back in-touch with you asap.